Top 5 Bitcoin IRA Companies: 5 Things to Know Before Investing

Source: gettyimages

Summary Table

Best Bitcoin IRA Companies at a Glance:

'Regal Assets Logo from regalassets.com'#1 Regal Assets | âBitCoin IRA Logo from bitcoinirainvestment.com'#2 Bitcoin IRA | âRetire With Choice Logo from retirewithchoice.com'#3 Retire With Choice | âTrust ETC Logo from trustetc.com'#4 Trust ETC | âiTrust CapitaLogo from itrustcapital.com'#5 iTrust Capital | |

|---|---|---|---|---|---|

| Full-Service Gold IRA | â

|

â

|

â |

â |

â |

| Fees | $250 Annually | $195 Annually + $50 Setup Fees | 1% Annually | $70 Annually + $50 One-time Fee | No Fees |

| Offers Other Alternative Assets | â

|

â |

â

|

â

|

â

|

| Storage | Cold Storage |

| Cold Storage |

| Cold Storage | Cold Storage | MPC Cold Storage | |||

| Headquarters | Los Angeles, CA | Los Angeles, CA | Murray, KY | West Lake, OH | Irvine, OH |

| Free Investment Kit | REQUEST FREE KIT | â |

â |

â |

â |

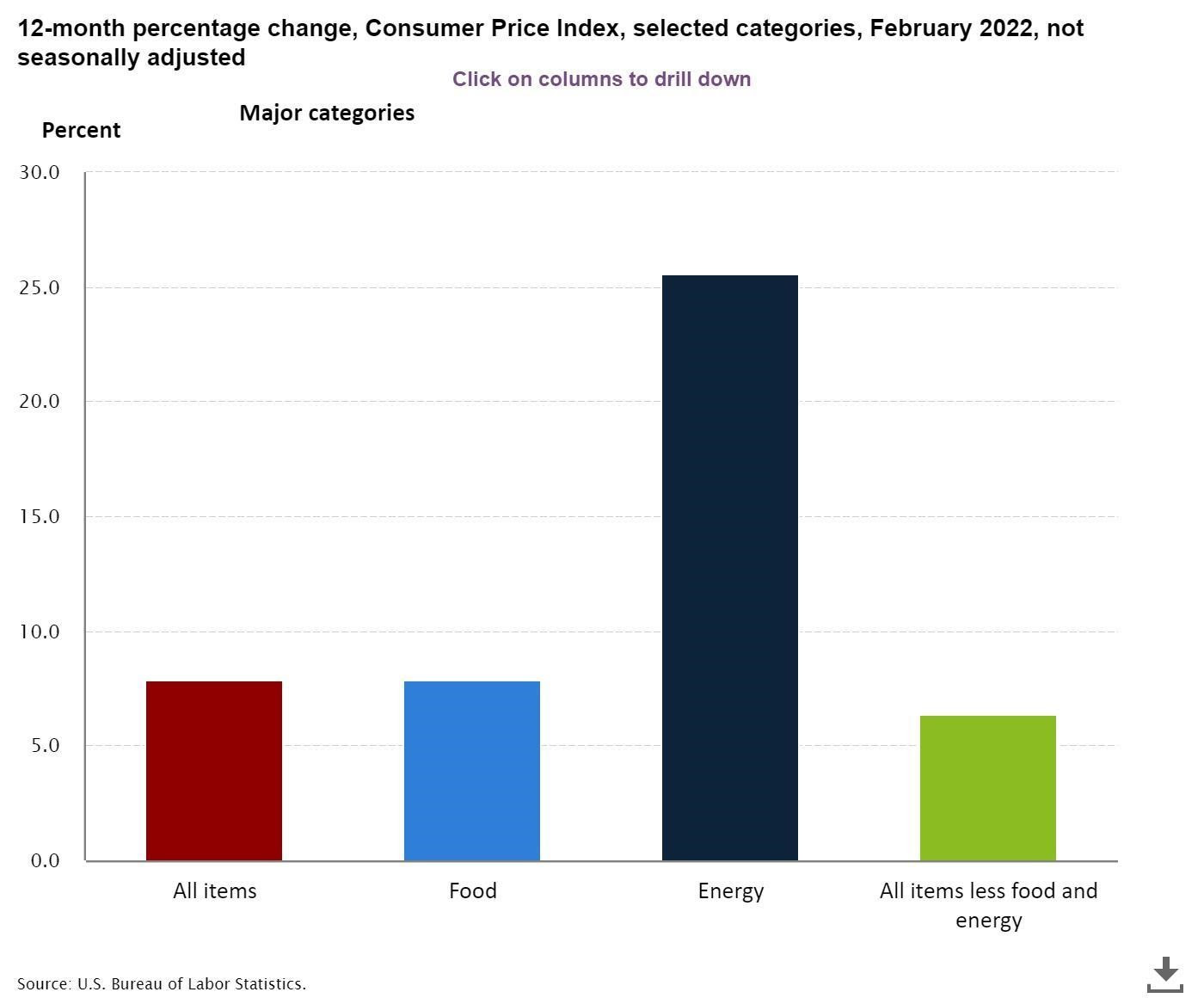

Chances are, youâve become quite nervous about your nest egg as of late. The Dow is in the midst of a 5-week losing streak, and Goldman Sachs says there is as high as a 35% chance of a U.S. recession in 2022. GS cut its U.S. GDP growth projection for the year to 1.75% from 2%.

Already soaring inflation is at its highest level in 40 years, and Russiaâs invasion of Ukraine has only made things worse.

Source: U.S. Bureau of Labor Statistics

Energy and commodity prices, which already were skyrocketing, have soared to record highs - and could easily hit new highs in 2022.

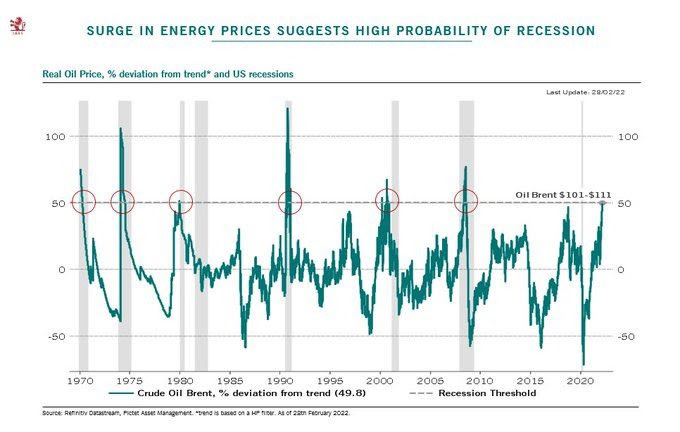

Crude oil prices traded as high as $113 a barrel by mid-March. Average U.S. gas prices exceeded $4 per gallon as the overall national average, and were closer to $6 a gallon in some states, such as California.

It goes deeper than just pain at the pump, however. When fuel prices rise, the rest of the economy feels the effects. Thatâs because transporting goods to market requires fuel for vehicles. Every recession might not be led by a sharp rise in fuel prices, but a rise in oil prices of 50% or more has nearly always been followed by a recession.

Source: Bianco Research Twitter

Oilâs price over the past year has more than doubled. If the current price trend continues, we could soon see the price of oil per barrel touch $200 or even $300.

If youâre nervous about your IRA and wondering how you can protect yourself, thatâs perfectly understandable. Many protect against economic risks by adding assets like gold and silver to their IRAs by working with IRS-approved custodians, brokers, and storage experts.

But are you aware that you can now do this with Bitcoin too?

What is a Bitcoin IRA?

Gold IRAs and Silver IRAs are retirement accounts that hold some of their value in said assets, and Bitcoin IRAs work the same way, holding Bitcoin and/or other cryptocurrencies as an asset.

Although Bitcoin IRAs have only recently become an option for investors, with the advent of cryptocurrencies and the noted benefits they can provide, more and more people are electing to create one.

According to CNBC, 2021 saw Bitcoin IRAs surge in popularity. Americans have flocked to these accounts as a way to chase Bitcoinâs gains over the long-term and to, hopefully, more rapidly grow a retirement nest egg while reducing their tax burden.

But before you jump into creating a Bitcoin IRA, there are a few things that you should know first.

1. Make Sure to Use the Right Kind of IRA

Remember: Bitcoin IRAâs are still in their infancy unlike Gold IRAâs. Assets like gold and silver have stored value for thousands of years and could be added to IRA accounts for 25 years now, ever since 1997âs Taxpayer Relief Act. So, of course, getting your IRA ducks in a row is the first step.

Traditional brokerage accounts typically do not support crypto investing. If they do, naturally, the opportunities for live trading are nil. Consider using a trusted Bitcoin IRA administrator, such as Regal Assets, to open up a Bitcoin IRA. Regal Assets was the first company in the IRA market to receive a crypto trading license and one of the first to offer all major crypto assets as part of a retirement account.

An âall-in-oneâ provider such as Regal Assets can facilitate the process of creating and managing a Bitcoin IRA from start to finish. Regalâs CEO, Tyler Gallagher, is as well-versed as anyone regarding the topic, and has been featured in publications such as Forbes, and is a member of Forbes Councils.

You have a choice of two types of self-directed retirement accounts you can use when establishing a Bitcoin IRA:

Roth Bitcoin IRA

- After-tax retirement savings account that works just like any other Roth IRA

- No upfront tax deduction with contributions

- Zero requirements to pay taxes on gains later on when you retire and begin to take distributions

Traditional Bitcoin IRA

- Tax-deferred retirement savings account

- Contributions reduce tax liability for the year they are made (In most cases, contributions are tax-deductible)

- Annual contribution limits are $6,000 if under age 50 and $7,000 if age 50 or above

- Must pay taxes on gains when you take distributions during retirement

Both types of IRA accounts offer tax benefits. Financial advisors sometimes note that if you expect to be in a higher tax bracket at retirement than you are now, a Roth IRA may work well, since you will pay a lower marginal tax rate on your contributions today. Conversely, individuals who expect to have a lower tax liability during retirement may want to opt for a traditional Bitcoin IRA instead.

If you have a Bitcoin wallet for your IRA, though, you can only fund it with your IRA. It is not legal to commingle your Bitcoin wallet with other IRA funds. If you try to skirt around this, you could wind up in some serious trouble with the IRS.

2. Diversification

According to Regal Assets CEO, Tyler Gallagher, âCryptocurrency is, more than anything, a diversification tool. Unlike other diversifiers, such as precious metals, Bitcoin is a highly asymmetrical investment. In other words, the upside potential (i.e., price ceiling) is much higher than the downside risk (price floor).â

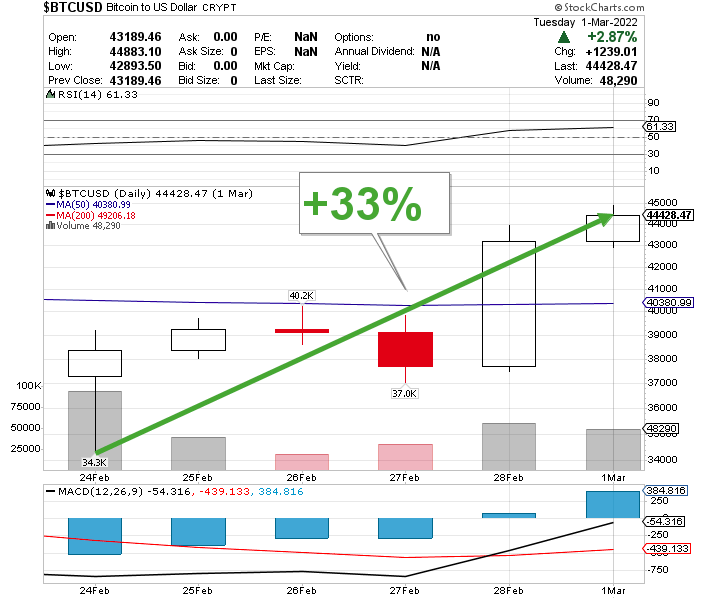

Bitcoin appears to be mimicking precious metals as a âsafe havenâ asset amid all of the geopolitical chaos in Europe. For example, during the week of the Ukraine invasion (Feb. 24-Mar. 1), the price of Bitcoin skyrocketed by roughly 33%.

Source: Stockcharts

For better or worse, as Russia becomes more isolated economically, the ruble crashes, and the rest of the world feels spillover effects from rising oil prices and inflation, crypto has a growing role in the investment market. Its decentralized qualities and seamless and borderless P2P payments have never been more crucial than now.

Bitcoin represents a sea change in financial systems. The existing, traditional financial infrastructure is composed of financial services firms that are tightly regulated by governments. The new financial infrastructure being created with cryptocurrencies is being built upon open-source, decentralized software that is not controlled by any organization.

Digital currencies represent a $2 trillion+ market value, currently have over 200 million users, and offer a new global financial system with improved transaction efficiency. Adding exposure to this type of asset in a retirement account could be an outstanding long-term play. Perhaps thatâs why over 80% of central banks worldwide are exploring Central Bank Digital Currencies and why the U.S. Federal Reserve is investigating a fully digital U.S. Dollar.

2021 was the third consecutive year that Bitcoin outperformed both gold and the stock market.

3. Limited Supply = Inflation Hedge

For years, according to Reuters, gold has protected investors from excessive inflation and currency debasement.

As inflation rises, the dollars you earn today will not have the same value or purchasing power tomorrow. Goldâs value has historically at least kept pace with inflation. One key reason is that gold is a scarce, finite resource. In times of political or economic uncertainty, goldâs demand typically skyrockets as investors seek protection.

We have a double-whammy right now, with inflation at a 40-year high and the worst invasion of a sovereign country in Europe since WWII. Yet Bitcoin could be even more tailor-made for this type of environment than gold ever was. Like gold, Bitcoin is a scarce, finite resource - its blockchain is hardcoded to limit circulation to a maximum of 21 million coins. Its supply cannot be artificially tampered with, and governments or central banks cannot print Bitcoins at will as they can fiat currencies.

Many prominent analysts speculate that Bitcoin may eventually take over gold's role as a store of value and long-term inflation hedge. Consider the following: Bitcoin currently commands approximately 20% of the âstore-of-valueâ market. If its market share were to grow to 50% over the next few years â even with no increase in the overall demand for stores of value, its price could easily rise to over $100,000. Institutional investors are clearly turning to Bitcoin as an inflation hedge.

4. Resistance to Confiscation

Love it or hate it, Bitcoin is decentralized and, at present, largely secure from government intervention. It is anonymous, cryptographically protected, and resistant to confiscation, theft, and seizure. Its decentralized nature provides both security from theft or fraud, as well as financial privacy.

Those are some of the reasons crypto demand has skyrocketed during the Russia-Ukraine crisis.

Russian President Vladimir Putin and other Russian officials are now frozen out of the traditional global financial system. Assets being seized, such as offshore bank accounts, have turned the Russian economy upside down. Ordinary Russians feel the pain, too, with the ruble worth less than a penny and the Russian central bank more than doubling its interest rate to 20%.

From the Ukrainian side, crypto has also served a vital need. People worldwide are donating crypto to Ukraine as a form of remittance. The anonymity of crypto donations reduces the risk of Russia seizing donations.

5. Know the Risks

The long-term potential for Bitcoin and cryptocurrency is undeniable. However, there are still several risks you must consider before taking the plunge and starting an IRA.

Like any other investment asset, Bitcoin has its share of risks. Because itâs still relatively new and subject to large volatile price swings. These risks could also be amplified. Regal Assets CEO Tyler Gallagher has mentioned volatility and erratic price movement, cybertheft, fraudulent exchanges, and a limited and unpredictable regulatory environment as the most significant risks to consider in a Forbes feature article.

Opportunity cost exists with Bitcoin, just as with any other potential investment. Opportunity cost means that whenever you invest in an IRA, you're missing out on dedicating your limited contribution space ($6,000-7,000 annually) to any other asset. There are also recurring custody and maintenance fees. Crypto trades may also have costs.

The risk of âforkingâ refers to when the Bitcoin blockchain goes through periodic modifications and updates as determined by a consensus of the users comprising its network. When Bitcoin forks, resulting price fluctuations may lead to a loss of investor confidence.

You can do your part to mitigate investment risk. Never invest more money than you can afford to lose, and make sure you create a Bitcoin IRA with a reputable provider.

Top 5 Companies for Adding Crypto to Your IRA

With cryptocurrency taking the world by storm we've seen some more experienced investors starting to think long-term about their crypto portfolios. Even some of the more novice investors have begun leaning towards longer time horizons regardless of their experience or lack thereof. Although tax regulation regarding cryptocurrency can be complicated and ever-changing, there is one aspect that wonât change. IRA accounts are the perfect way to save up for retirement or put money away for the long term with the benefit of a tax deduction. Just like a traditional IRA with one of your standard brokerage platforms, there are now companies that allow you to invest in cryptocurrency through an IRA. Letâs dive into some of the best options available to crypto investors looking for a tax-friendly way to invest for the long run.

#1 - Regal Assets

- URL: www.regalassets.com

- Phone: 877-205-1104

- Years in Business: 11

- Bitcoin IRA Annual Fees: $250

- Full-Service Bitcoin IRA: Yes

- Insured Bitcoin IRA? Yes

Regal Assets was founded by entrepreneur and investor, Tyler Gallagher. Tyler is a member of the Forbes Financial Council and the Rolling Stone Council. He built the company from the ground up with minimal capital, but a big vision and innovative outlook on alternative asset investment. Within 10 years Regal has become the highest-rated alternative asset firm in the country and has gotten recognition from Forbes, Smart Money, and The Huffington Post. The firm's main focus is helping individual investors add metals and now crypto to their portfolios and retirement accounts. Regal Assets also has recently had famous personalities become clients such as Karl Anthony Towns of the NBA and Hollywood Actor Jordyn Woods.

Their flagship account is the Regal IRA. This is the worldâs first alternative asset IRA offered to individual investors. This allows investors to invest in physical metals, where standard brokerage accounts would only allow an investor to purchase an ETF, or equivalent, for various metals. Regal Assets is one of the only companies that charge zero fees when selling your assets.

Pros:

- Great for new investors looking to expand into crypto

- Great for experienced investors looking to add crypto to their long term portfolios

- Clear description of what exactly you can invest in with their flagship account

Cons:

- Not the most user-friendly site, but very resourceful once you get started

#2 - Bitcoin IRA

- URL: bitcoinira.com

- Phone: 877-936-7175

- Years in Business: 5

- Bitcoin IRA Annual Fees: $240

- Full-Service Bitcoin IRA: Yes

- Insured Bitcoin IRA? Yes

Bitcoin IRA is a full-service solution to adding cryptocurrency to your IRA and was founded by Camila Concha, Chris Kline, and Johannes Haze. Each founder has an impressive background and it is not their first endeavor. It is a fully self-trading platform so the user must make all of their investment decisions. They offer an app for their users on both Android and iOS, which is helpful and convenient for any trading account and a great way to watch your money grow. Their two account options are an IRA or an interest-bearing crypto account. Both are great options for someone thinking long-term for their crypto portfolio.

Pros:

- Apps available for all operating systems

- Allow you to borrow against crypto

- Very user-friendly site and app

Cons:

- Not very clear what exactly you can and cannot invest in

- Offers 6% monthly payouts on IRA accounts, which brings up some tax concerns regarding withdrawing from an IRA and isnât explained well on the site

#3 - Retire With Choice

- URL: www.retirewithchoice.com

- Phone: 270-226-1000

- Years in Business: 11

- Bitcoin IRA Annual Fees: No Annual Fee

- Full-Service Bitcoin IRA: Yes

- Insured Bitcoin IRA? Yes

Choice offers one single account for all your alternative investments to be in one place. They have partnerships with both Interactive Brokers and Kraken for their users to trade crypto and other alternative asset classes. The site also offers accounts for professional advisors to manage accounts on behalf of their clients. Professionally, there are not many options out there like this.

Pros:

- Easy watchlists on the platform and a great breakdown of your investments

- Gives users access to all assets from stocks to crypto to gold

Cons:

- Only offers one account for all assets; investors are capped with their annual IRA contribution and if you want to add crypto to your long-term retirement account it would make sense to use a site tailored toward just that. However overall a great site for investors and pros.

#4 - Trust ETC

- URL: www.trustetc.com

- Phone: 855-233-4382

- Years in Business: 47

- Bitcoin IRA Annual Fees: $300

- Full-Service Bitcoin IRA: Yes

- Insured Bitcoin IRA? Yes

Equity Trust offers professional and non-professional self-directed accounts for traditional investments and alternative investments all in one account. They offer a wide variety including mortgage notes, peer-to-peer lending, private equity, and as weâve been discussing, crypto and metals. Overall they are a great one-stop-shop for more types of accounts that we have the space to type out, which says a lot about their experience in so many different spaces. They also offer individual consulting for newer investors looking to get a head start on their investments.

Pros:

- A wide variety of assets classes is offered

- Offer products and accounts for individuals, businesses, and professional investment managers

Cons:

- A one-stop shop is great, but not heavily focused on being able to add cryptocurrency to your IRA as the other options weâve discussed

#5 - iTrust Capital

- URL: itrustcapital.com

- Phone: (562) 600-8437

- Years in Business: 3

- Bitcoin IRA Annual Fees: No Fees

- Full-Service Bitcoin IRA: Yes

- Insured Bitcoin IRA?: Yes

iTrust Capital is a software platform that allows clients to self-trade in cryptocurrencies, physical gold, and physical silver in their self-directed IRA accounts. They have low transaction fees and also allow users to buy and sell 24 hours a day, unlike some similar platforms. Client assets are held in institutional-grade storage solutions, with best-in-class security. According to their site, precious metals are held at the Royal Bank of Canada. They offer an easy to use platform to invest in cryptocurrency and precious metals online; the recent explosion of interest in cryptocurrency and security has continued to be a large concern which they seem to combat very well.

Pros:

- Institutional-grade storage, with best in class security

- Very upfront about their fees

- Great reviews listed on their site which we verified

- Heavily focused on tax benefits, so for investors looking long term this should be a contender

Cons:

- Limited amount of cryptocurrency selection

Summary Table 2

Best Bitcoin IRA Companies at a Glance:

'Regal Assets Logo from regalassets.com'#1 Regal Assets | âBitCoin IRA Logo from bitcoinirainvestment.com'#2 Bitcoin IRA | âRetire With Choice Logo from retirewithchoice.com'#3 Retire With Choice | âTrust ETC Logo from trustetc.com'#4 Trust ETC | âiTrust CapitaLogo from itrustcapital.com'#5 iTrust Capital | |

|---|---|---|---|---|---|

| Full-Service Gold IRA | â

|

â

|

â |

â |

â |

| Fees | $250 Annually | $195 Annually + $50 Setup Fees | 1% Annually | $70 Annually + $50 One-time Fee | No Fees |

| Offers Other Alternative Assets | â

|

â |

â

|

â

|

â

|

| Storage | Cold Storage |

| Cold Storage | Cold Storage | Cold Storage | MPC Cold Storage | ||

| Headquarters | Los Angeles, CA | Los Angeles, CA | Murray, KY | West Lake, OH | Irvine, OH |

| Free Investment Kit | REQUEST FREE KIT | â |

â |

â |

â |

Conclusion: Wrapping Up

Never has there been a more opportune time to create a Bitcoin IRA. Many saw Bitcoin and other cryptocurrencies as a fad and little more than a gimmicky slot machine. But, now, with inflation and geopolitical tensions, we are seeing the purpose it serves in real-time. Itâs probably no coincidence that Colorado became the first U.S. state to accept crypto for tax payments during the second week of the Russia-Ukraine war.

We are still in the infancy of a new asset class that could completely transform finance. The key is to look at the long-term potential and make sure that you do your due diligence. If you are a believer, there is no reason not to take the plunge and start a Bitcoin IRA.

Just do your research to find a knowledgeable, reputable Bitcoin IRA provider. One decision youâll have to make is whether to go with an all-in-one firm, such as Regal Assets, that handles purchasing crypto, Bitcoin IRA management, and storage, all in-house â or with a provider that merely connects you with appropriate third parties to handle custodial management and IRS-approved storage.

To find out more about how an Bitcoin IRA can work for you, take advantage of Regal Assets FREE Investment Kit or give them a call on 1-877-962-113 for more information.

REQUEST FREE KIT

About the Author

Robert Samuels is a financial copywriter and business consultant who has worked with various clients in numerous industries and sectors. He received his undergraduate degree from the University of Maryland and worked in music, sports, and entertainment for several years. Capped by a successful exit after selling a boxing website, Robert soon relocated overseas for a few years. After teaching himself stock market basics and financial fundamentals, he leveraged this newfound passion into a Masterâs Degree from Harvard Universityâs ALM Finance extension program, where he received a 3.87 GPA and Deanâs List distinction.

Through this program, Robert also acquired a graduate certificate in Real Estate Investment and a graduate certificate in Corporate Finance. With a diverse professional background, both as an employee and entrepreneur, Robert is highly driven, passionate, and a great communicator who loves discussing finance.

![]()