For all its billion-dollar gyrations, the actual investment strategies behind a highly valued and hotly debated stock portfolio of The Church of Jesus Christ of Latter-day Saints appears to be a relatively staid affair.

Analysis of the $54.7 billion stock fund managed by the faith’s investment arm, Ensign Peak Advisors, shows money managers have carefully steered those huge holdings to closely mirror the investment mix of a leading stock index known as the S&P 500, which tracks the performance of 500 of the largest publicly traded U.S. companies.

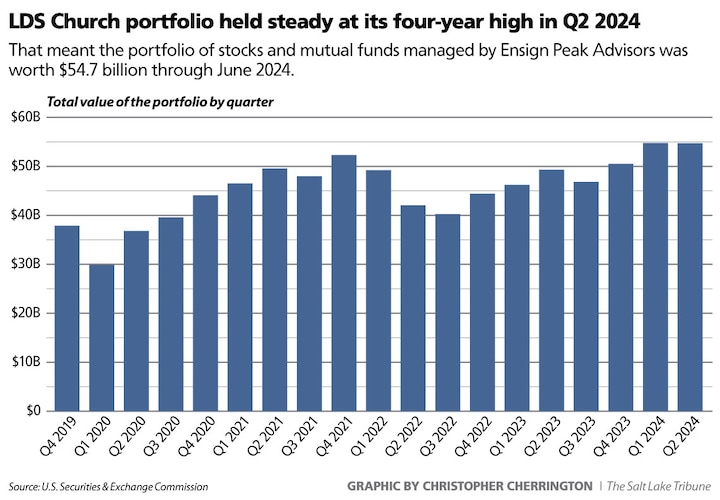

The account has grown from a pandemic-related low of $29.9 billion at the start of 2020 to $54.7 billion at the end of June — an overall gain of about 83%.

(Christopher Cherrington | The Salt Lake Tribune)

This fund is, of course, only a portion of the Utah-based church’s overall wealth, representing the U.S. stocks it holds directly and is required to report.

According to one publicly reported estimate, Ensign Peak and affiliated funds manage investments on behalf of the global faith of 17.2 million members worth a total of $179 billion to $205 billion.

The Widow’s Mite Report, a website devoted to research and analysis of the church’s financial holdings, also projects the church could be worth at least a trillion dollars by 2044.

In-depth looks at the portfolio since it began reporting to federal regulators in 2020 show that in hopes of beating the market, Ensign Peak managers have sometimes skewed the church’s investments toward major stocks in the S&P 500 that they expect might perform better quarter to quarter.

There also has been occasional evidence of more reactive trading, including a 2021 gambit on stock in video game retailer and social-media darling GameStop that saw its initial $867,000 investment swell to $8.7 million in a matter of months.

And as with the stock balance of the S&P 500 overall, Ensign Peak has dominant stakes in big technology firms such Amazon, Apple, Facebook, Google, Microsoft and, increasingly, Nvidia, maker of software and hardware integral to the proliferating field of artificial intelligence.

Ensign Peak’s overall approach, according to portfolio analysis that includes stock dividends as well as price fluctuations, has produced a revised 13.1% annualized return for the Salt Lake City-based fund since the end of 2019.

By comparison, financial analysts with Widow’s Mite noted in updated figures, the S&P 500 index produced yearly investor gains of 14.2% over that same time.

In other words, had Ensign Peak managers invested in a vanilla S&P 500 index fund over the past four-plus years instead of spreading their portfolio over as many as 2,308 separate stocks, mutual funds and other investments, they would have earned roughly $3 billion more than they did.

That lag in performance, Widow’s Mite added, was potentially due to poor stock selection, off-kilter market timing, reactive or excessive stock trading or biases by managers toward certain investment styles or favoring some industries over others.

Its portfolio analysis also shows Ensign Peak has been a net seller of stocks since the start of 2023, when it dumped nearly $504 million in shares in the first quarter.

In the latest quarter, it sold off $1.6 billion, for total stock sales in 2023 and 2024 of nearly $5 billion.

Widow’s Mite said it suspected that Ensign Peak was in the process of reallocating its stake in U.S. stocks to other investments such as real estate, bonds and private equity — possibly in anticipation of better returns.

Based on a host of public financial disclosures, church reports, stock and index data and professional-grade analysis tools, researchers at the site estimate the church’s total wealth at about $265 billion at the end of 2023, including operating assets, real estate and other investments.

Investments such as the funds at Ensign Peak and the financial endowments for church-owned Brigham Young University in Provo, the website said, made up about $182 billion of that total.

Editor’s note • This story is available to Salt Lake Tribune subscribers only. Thank you for supporting local journalism.