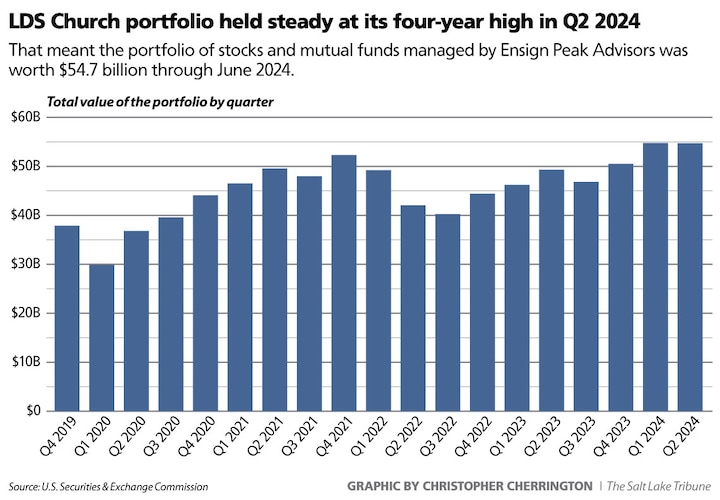

After reaching a four-year high in late March, the headline-grabbing investment portfolio of The Church of Jesus Christ of Latter-day Saints held steady through spring and early summer.

New federal reports filed by the global faith’s Ensign Peak Advisors indicate its holdings in stocks, mutual funds and other investments were worth $54.7 billion at the end of June — $32 million below where they were when the first quarter of 2024 ended.

Though Ensign Peak typically mirrors the mix of stocks in the S&P 500, it was down 0.06% for the second quarter, well behind that index’s 3.92% gain.

That scant quarter-to-quarter dip is the smallest change for that vast pool of investments since Ensign Peak began disclosing its contents to the U.S. Securities and Exchange Commission, showing the previously hidden account’s total value at $37.8 billion at the end of 2019.

Despite trending essentially sideways over April, May and June, the publicly reported portfolio remains nearly $25 billion ahead of its pandemic-era low, when fluctuating markets sent it below $29.9 billion in early 2020.

The latest SEC disclosures do not reflect the turmoil in August that saw key market measures such as the Dow Jones Industrial Average and S&P 500 plunge on fleeting reports that the U.S. economy might be tilting toward recession.

(Christopher Cherrington | The Salt Lake Tribune)

The Ensign Peak investment account also represents only the Utah-based faith’s direct ownership of U.S. stocks and mutual funds exceeding a regulatory threshold of $100 million.

Independent financial analysis by The Widow’s Mite website suggests the $54.7 billion in reportable investments managed by the church firm is part of an estimated $265 billion in wealth held by the 17.2 million-member worldwide faith, including its landholdings of about 2.3 million acres in the U.S. alone.

At current rates of growth, according to The Widow’s Mite, the church will be worth more than $1 trillion within 21 to 27 years.

Along with shares in a wide range of blue-chip, mid-cap and smaller stocks across industries, the Ensign Peak account includes major investments in mutual, index and sector-targeted funds; real estate investment trusts; hedge funds; and a host of foreign companies held through depository receipts.

Though the church-owned wealth-management firm was created in 1997, its size and scope came to light via SEC filings after an IRS whistleblower alleged in late 2019 that the account had reached upward of $100 billion — with none of it, the whistleblower asserted, spent on religious or charitable causes.

Money managers at Ensign Peak sold shares in big technology stocks Amazon, Apple, Facebook, Google and Microsoft in the second quarter, reports show, but their holdings in each still topped at least $1 billion. The portfolio’s single largest stake is now in Microsoft, valued at $3.4 billion.

Its stake in Nvidia, currently a dominant U.S. supplier of hardware and software for the burgeoning field of artificial intelligence, jumped from $2.5 billion to $3.3 billion in the second quarter and is now the second-largest holding.

Shares in the California technology firm weren’t even among Ensign Peak’s top 10 stocks at the end of 2022.

Tech giant Apple ranks as the portfolio’s third-biggest stake, at $3 billion, followed by shares in Alphabet, formerly known as Google, at $2.2 billion, and Facebook’s parent company, Meta, at $1.6 billion.

Disclosures also show the investment firm has trimmed the overall number of different investments in its portfolio every quarter since September 2022. The portfolio now stands at 1,712 positions, down from a high of 2,308.

Editor’s note • This story is available to Salt Lake Tribune subscribers only. Thank you for supporting local journalism.