The leader of a referendum campaign seeking to overturn recent changes to the state’s tax laws declared an early, and unofficial, victory Tuesday shortly after the deadline for submitting petition signatures to county elections offices.

Fred Cox, a former state lawmaker, said internal tracking showed that campaign volunteers collected roughly 152,000 signatures statewide — exceeding the 116,000 required to qualify for the ballot — and meeting minimum signature thresholds in at least 18 counties.

“The people have finally been heard,” Cox said. “And that’s what they really want. They want the Legislature to hear what they’re saying, and the answer is ‘no.’ ”

A successful signature drive would put on hold a bill approved by lawmakers during a December special session that cuts overall taxes by $160 million through a combination of tax cuts and increases. The state’s voters would then be able to vote in November whether to enact or repeal the legislation.

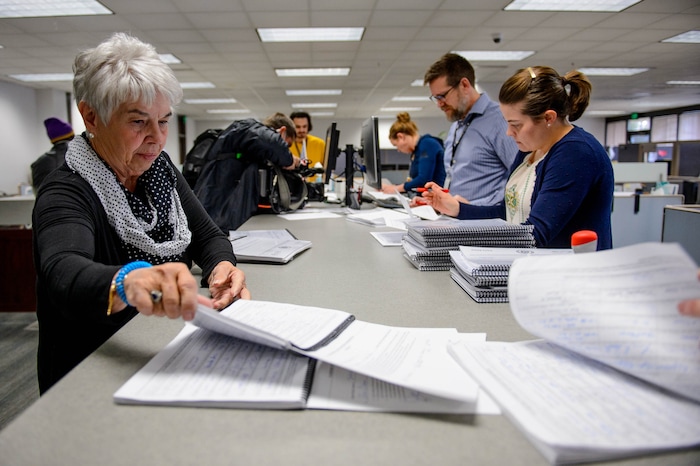

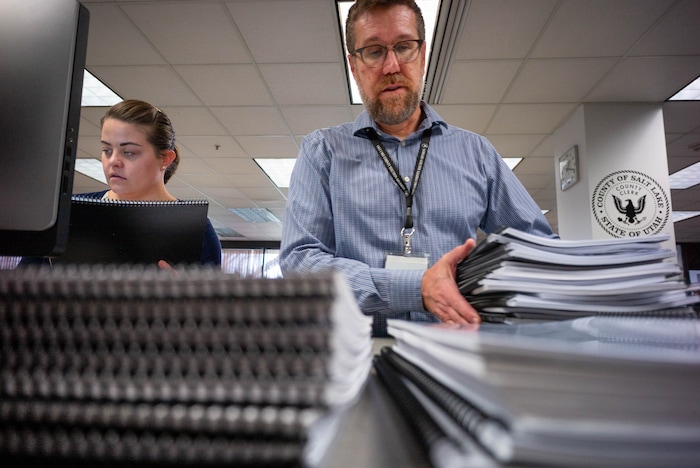

But a formal count of the campaign’s signatures was not immediately available Tuesday — it could take up to two weeks for county elections office to verify petition forms. Individuals who added their names to the campaign’s petition will also have an opportunity to remove their signatures following that formal count, which could further trim the number of verified signatures.

The Utah Lieutenant Governor’s Office announced that as of 5 p.m. Tuesday, only 58,000 signatures had been verified. But Justin Lee, state elections director, said that total does not yet include all of the petitions submitted Tuesday, including a significant number collected in Salt Lake County.

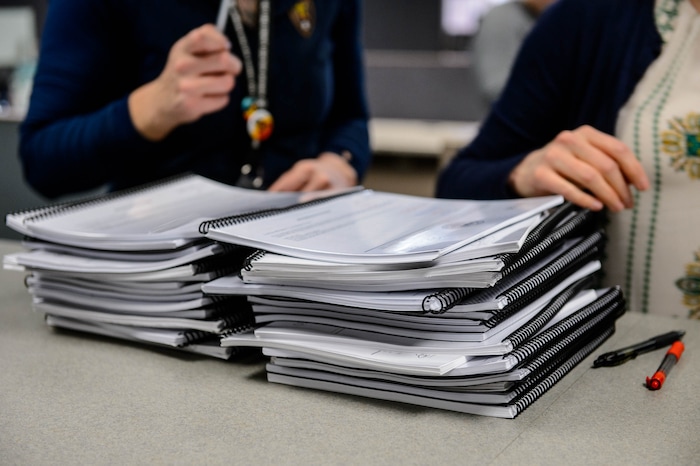

Throughout Tuesday afternoon, a system of couriers and volunteers used by the referendum campaign generated a steady stream of signature packets being delivered and submitted to the Salt Lake County clerk’s office.

Claudine Peterson was stationed outside the office for the bulk of the afternoon and estimated that there had been 200 different petition dropoffs, some with large numbers of packets collected at grocery stores and others with only partially completed forms collected by individual volunteers.

Peterson also collected signatures as she stood at the curb, and said she had added about 40 names to the petition rolls.

She said there are some elements of the tax legislation that she could support, but that more work is needed before enacting a package of reforms.

“I’d like to see it rewritten,” Peterson said.

Included in the bill approved by lawmakers are cuts to income taxes, an expansion of the per-child dependent exemption and increases to the sales taxes on food, fuel and some services. The bill also creates a series of new tax credits for low- and middle-income Utahns, which are intended to mitigate the effect of the increased taxes on purchases.

The changes translate to an overall tax cut of $160 million to the state, but critics say the bill will negatively impact residents and small businesses through higher taxes on food, fuel and some services.

The referendum effort received a boost of public support from the Utah-based grocery chain Harmons, which came out in opposition to the Legislature’s tax changes — particularly an increase to the tax on groceries — and made its locations available for signature gathering. The grocer also took out full-page ads in the state’s major newspapers opposing the grocery tax and encouraging readers to add their signatures to the referendum effort.

Harmons Chairman Bob Harmon said Thursday that there was a risk to joining the referendum effort, but that it was a risk worth taking.

“It wasn’t a very difficult decision for us to make,” he said. “We care about all of the communities that we serve.”

Judy Weeks-Rohner, one of the sponsors of the referendum campaign, said it was common for there to be lines of residents waiting to sign packets at the grocery store locations.

“Let me tell you,” she said, “they were coming to us.”

Weeks-Rohner said she was concerned about the tax legislation’s effect on groceries and gasoline, and how the cut to state revenue could affect public education. She also said she worries about the less-publicized “hidden aspects” of the bill, such as how it directs state agencies to begin preparing for toll roads and other vehicle-user fees as a means of funding state transportation projects.

And after weeks working to collect signatures, Weeks-Rohner said she was looking forward to taking a break, whether or not the campaign qualifies for the November ballot.

“Because of this, I have not had a chance to buy my grandchildren a Christmas present,” she said.

Lawmakers are set to convene later this month in their annual 45-day session, which will include passing budgets for the coming year. The tax referendum, if it successfully qualifies for the ballot, could complicate those negotiations by halting implementation — and potentially repealing outright — of changes to the state’s revenue collections.

Cox said that budget challenges existed before the referendum, and will continue during and after. He said the state continues to collect surplus funds, and suggested lawmakers could save tax revenue in state reserve accounts if necessary until the public vote.

“There is money they have to fund our state,” Cox said. “And they don’t have to raise any taxes to do it.”